ABOUT CFPAU.org

Posted by Admin | Aug 11, 2020 | CONSUMER FINANCIAL PROTECTION ADVOCATES UTAH — CFPAU.org | 0

Select Page

Posted by Admin | Aug 11, 2020 | CONSUMER FINANCIAL PROTECTION ADVOCATES UTAH — CFPAU.org | 0

Posted by Admin | Jun 24, 2020 | Fraud News, Uncategorized | 0

Posted by Admin | Jan 29, 2020 | CONSUMER FINANCIAL PROTECTION ADVOCATES UTAH — CFPAU.org | 0

Posted by CFPAU Admin | May 11, 2025 | Consumer Complaints | 0

Posted by Admin | Jun 14, 2023 | Consumer Advice, Consumer Complaints, Fraud Warnings | 0

Posted by Admin | May 21, 2023 | Fraud Warnings, Consumer Affairs Agencies, Consumer Fraud Education | 0

While their website paints a serene picture of a "ranch-based environment" with comprehensive mental health treatment, our in-depth analysis and one parent's awful and stress filled personal experience suggest a starkly different reality lurking beneath the surface.

The National Council of Nonprofits recently shared information on tax scams identified by the Internal Revenue Service that are targeting nonprofit organizations. The IRS released its annual Dirty Dozen list representing, as they put it, “the worst of the worst tax scams.” Among this year’s scams is aggressive marketing schemes to con ineligible nonprofits to claim ERTC benefits.

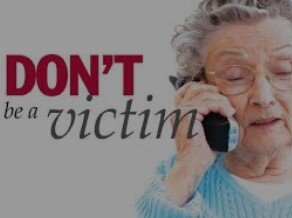

Seniors are often targeted for elder fraud because they tend to be very trusting and polite. Seniors usually have significant financial savings, own a home, and have good credit—all of which make them attractive for scams.

Since the engineering work involved in a survey and the terms and equipment is far beyond the scope of what a layman could do, have or know, and most people assume the land surveyor or engineer must be honest to be licensed, they don't suspect this fraud. It's real and it has happened to me, but I caught it in time!

President John F. Kennedy, in his speech in 1962, introduced the Consumer Bill of Rights to Congress. He mentioned four basic consumer rights: the right to safety, the right to be informed, the right to choose and the right to be heard. Later, during the 1980s, these four basic consumer rights were expanded to eight. These eight rights are described in this article.

Aug 15, 2020

Breaking and Latest news on the Utah State Legislature, Money laundering, Fraud, Corruption, Bribery, Tax Evasion, and other financial crimes.

On Jan. 8, Owens’ federal filing with the U.S. House of Representatives stated: “I’ve resigned day to day involvement as CEO [of SC4Y] but will continue compensation of $70,000/year as Founder and Board Chairman.”How much went directly to helping incarcerated youths? Zero, according to the records.

Making the choice between buying and leasing has often been difficult. On one hand, buying involves higher monthly costs, but you own something in the end. On the other, a lease has lower monthly payments, but you get into a cycle where you never stop paying for a vehicle.

Specific advice and questions to ask your current and future advisors to determine in any hidden compensation or conflicts of interest. You will be be able to week out the “bad advisors”, and find a good advisor.

The Troubled Teen Industry: A National Outrage Utah’s Troubled Teen Industry (TTI) has always been...

We are a non-profit organization with the purpose of helping consumers that have been harmed by unethical or illegal actions by Utah companies, licensed professionals and others.

While we are a non-governmental agency, unincorporated nonprofit association, that began 2018. In September of 2020 Kathy Nicholson took over CFPAU.org, with Erica Crawford remaining as Managing Director.

In January of 2022 the CFPAU.org Directors made the wise decision as a nonprofit, that it was best to unincorporate by allowing the registration expire and for it to become an unincorporated nonprofit association.

Since CFPAU.org does not accept any donations and all work is done by volunteers we accept zero financial funding, nor do we provide any funding.

All funds negotiated for refunds or settlements go directly to victims. This is important because we must remain above any influence and remain objective and unbiased in our consumer research and reports. That is why we refuse any payment for our services.

There are no CFPAU financial accounts. We are a unincorporated nonprofit association operated by volunteers, we advocate for consumer victims with state and industry agencies and often meet with state leaders to create better legislation to protect consumers.

We also provide consumer review reports, and opinions about victim experiences with professionals and companies and organizations that our in depth research has indicated is harmful to consumers. To learn more about our organization, please visit our policy page at https://cfpau.org/policy