Category: Fraud News

Warnings by the Consumer Financial Protection Bure...

Posted by Admin | Aug 16, 2020 | Fraud News | 0

Newsroom Consumer Financial Protection Bureau

Posted by Admin | Aug 15, 2020 | Fraud News | 0

Salt Lake City FBI White-Collar Crime Squad Descri...

Posted by Admin | Jun 24, 2020 | Fraud News, Uncategorized | 0

- Consumer Complaints

- Consumer Affairs Agencies

- Senior Alerts

- Fraud News

Wildflower Mountain Ranch Residential Treatment Center

While their website paints a serene picture of a "ranch-based environment" with comprehensive mental health treatment, our in-depth analysis and one parent's awful and stress filled personal experience suggest a starkly different reality lurking beneath the surface.

Scam Alert: Beware of ERTC Firms Bearing Gifts

The National Council of Nonprofits recently shared information on tax scams identified by the Internal Revenue Service that are targeting nonprofit organizations. The IRS released its annual Dirty Dozen list representing, as they put it, “the worst of the worst tax scams.” Among this year’s scams is aggressive marketing schemes to con ineligible nonprofits to claim ERTC benefits.

Elder Fraud Advisory

Seniors are often targeted for elder fraud because they tend to be very trusting and polite. Seniors usually have significant financial savings, own a home, and have good credit—all of which make them attractive for scams.

Fraud Alert Utah Land Surveyor Scams

Since the engineering work involved in a survey and the terms and equipment is far beyond the scope of what a layman could do, have or know, and most people assume the land surveyor or engineer must be honest to be licensed, they don't suspect this fraud. It's real and it has happened to me, but I caught it in time!

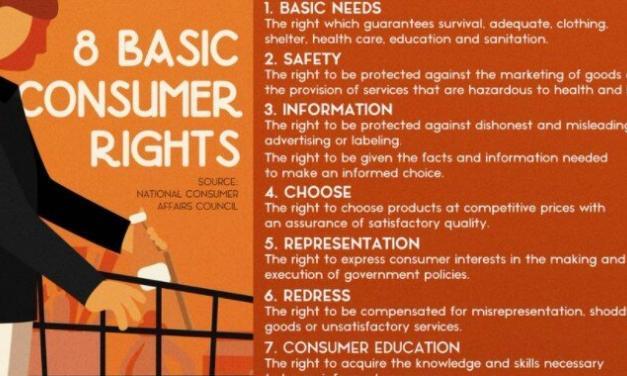

Consumer Rights

LatestThe 8 Consumer Rights of Every American

President John F. Kennedy, in his speech in 1962, introduced the Consumer Bill of Rights to Congress. He mentioned four basic consumer rights: the right to safety, the right to be informed, the right to choose and the right to be heard. Later, during the 1980s, these four basic consumer rights were expanded to eight. These eight rights are described in this article.

Financial Reports

LatestFinancial Crimes News

Aug 15, 2020

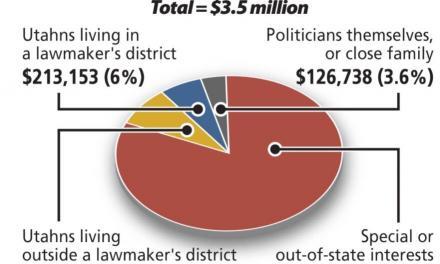

Breaking and Latest news on the Utah State Legislature, Money laundering, Fraud, Corruption, Bribery, Tax Evasion, and other financial crimes.

Legislator Watch

LatestA Second Look at Burgess Owens’ Second Chance 4 Youth Nonprofit

On Jan. 8, Owens’ federal filing with the U.S. House of Representatives stated: “I’ve resigned day to day involvement as CEO [of SC4Y] but will continue compensation of $70,000/year as Founder and Board Chairman.”How much went directly to helping incarcerated youths? Zero, according to the records.

Credit, Loans & Debt

LatestShould You Buy or Lease a Car?

Making the choice between buying and leasing has often been difficult. On one hand, buying involves higher monthly costs, but you own something in the end. On the other, a lease has lower monthly payments, but you get into a cycle where you never stop paying for a vehicle.

Money Management

LatestAvoiding Bad Financial Advisors

Specific advice and questions to ask your current and future advisors to determine in any hidden compensation or conflicts of interest. You will be be able to week out the “bad advisors”, and find a good advisor.

Consumer Advice

LatestConsumer Warning Report: Utah’s Troubled Teen Industry

The Troubled Teen Industry: A National Outrage Utah’s Troubled Teen Industry (TTI) has always been...

Fraud Warnings, Insurance Issues, Investment Issues, Retirement Plans

Latest

INFORM Consumers Act takes effect on Jun...

Jun 14, 2023

Consumer Warning & Alert CFP Board ...

Jun 14, 2023

Scam Alert: Beware of ERTC Firms Bearing...

May 21, 2023

Utah State Bar: Lawyer Complaints &...

Sep 2, 2020

Fraud Alert: Avoid Affinity Frauds &...

Aug 30, 2020

Fraud Alert: Insurance Companies

Aug 30, 2020

Senior Alert: Buy Into a Retirement Comm...

Aug 29, 2020

Watch Out For the Hidden Fees in the Fin...

Aug 29, 2020

Utah Fraud Victim Describes Her Ordeal W...

Jun 24, 2020

About This Site

We are a non-profit organization with the purpose of helping consumers that have been harmed by unethical or illegal actions by Utah companies, licensed professionals and others.

While we are a non-governmental agency, unincorporated nonprofit association, that began 2018. In September of 2020 Kathy Nicholson took over CFPAU.org, with Erica Crawford remaining as Managing Director.

In January of 2022 the CFPAU.org Directors made the wise decision as a nonprofit, that it was best to unincorporate by allowing the registration expire and for it to become an unincorporated nonprofit association.

Since CFPAU.org does not accept any donations and all work is done by volunteers we accept zero financial funding, nor do we provide any funding.

All funds negotiated for refunds or settlements go directly to victims. This is important because we must remain above any influence and remain objective and unbiased in our consumer research and reports. That is why we refuse any payment for our services.

There are no CFPAU financial accounts. We are a unincorporated nonprofit association operated by volunteers, we advocate for consumer victims with state and industry agencies and often meet with state leaders to create better legislation to protect consumers.

We also provide consumer review reports, and opinions about victim experiences with professionals and companies and organizations that our in depth research has indicated is harmful to consumers. To learn more about our organization, please visit our policy page at https://cfpau.org/policy

OUR FACEBOOK PAGE

OUR TWITTER FEED

[fts_twitter twitter_name=CFPAUtah tweets_count=6 cover_photo=yes stats_bar=no show_retweets=no show_replies=no]