Watch Out For the Hidden Fees

in the Financial Planning Industry

More than 90 million Americans have mutual funds and don’t know about the costs of commissions and hidden or extra fees and the alternatives to avoid them!

Choosing a financial advisor is a major life decision that can determine your financial trajectory for years to come.

According to a 2019 study by Northwestern Mutual, U.S. adults who work with a financial advisor report “substantially greater financial security, confidence and clarity than those who go it alone.”

While the value of working with an advisor varies on an individual basis, research suggests average additional investment returns can range from 1.5% to 4% more each year. See Source

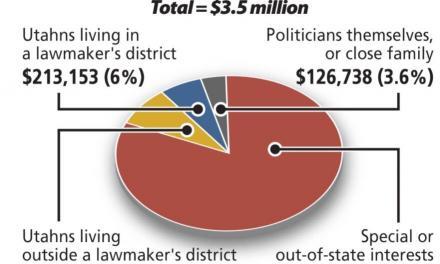

Did you know that just an annual expense ratio of 1% on a 401(k) plan can add up to a significant amount of money over 10 to 20 years? That 1% on an investment of $200,000 can cost $2,000 in hidden fees annually! Not only that but over a 30-year span, those hidden fees of 1% can cut overall growth on a $200,000 401(k) plan returns by 15%! Expense fees can be quickly looked up on Morningstar. Those fees do not show up on your statement. Rather the resulting returns are decreased based on the fee. Other fees show on yr statement, but mutual find expenses do not.

So first of all, if you invest in Mutual Funds, only invest in “no-load” mutual funds that DO NOT have 12b-1 fees annually or charge a shareholder servicing fee, account maintenance fee and, revenue-sharing fee these are supposed to be disclosed in the summary prospectus your broker or planner is supposed to provide you.

Much of those fees are paid from your account to your planner/broker annually. Index Funds that mirror various types of mutual fund groups can cost a tiny fraction of what Mutual Funds cost to purchase and hold.

Consider using a fee-based financial advisor that is very experienced in managing index funds; depending on the number of your investments, they may charge 1/2 of 1% to 1% of your investment but don’t pay more than that. Most likely, it will be much less than the total of front-end commissions, 1% or so 12-b1, and other annual fees.

Most Financial Advisors today only talk about these types of investments in the stock market as if they are the only investments as this is how most planners and brokers earn their income! Beware of those.

Please read our Consumer Warning & Alert about the CFP® & CERTIFIED FINANCIAL PLANNER™ trademarks owned by the CFP Board of Standards, Inc. at https://cfpau.org/consumer-warning-alert-cfp-board-of-standards-inc/

We recommend diversified investment portfolios, which also include direct investments in real estate, collectibles, and precious metals. Discussing the hidden fees and costs in all of these would best be in another question.