Warning: Utah’s Secret “Legalized Loan Sharking”

More Politely Called “Payday Lending”

Utah The Loan Shark State

“Get your money fast”; “Easy money”; “Get your loan today!”; Getting a loan these days especially with less than perfect credit can be next to impossible, so buzzwords like the ones here might entice anyone needing to make ends meet at the end of the month or between checks. The loans that were advertised with these slogans are called Deferred Deposit Loans. Never heard of that? Neither had I. Right now with COVID and the economy struggling, those that are most vulnerable will be needing and looking for any help that is available to them. I delved in deeper to see what kind of loans these are and if they could actually help people.

It’s a little known problem among the silent and unseen working poor. What I found is that a deferred deposit Loan is a fancy term for Payday Lending or a Car Title loan. Utah is one of two states that have few requirements for these lenders to loan you money. Payday lenders in our state can charge up to 658 percent interest on these loans, not to mention there is no cap for fees. There are no minimums or maximums to the amount they can loan you.

These loans are meant to be short term, no longer than ten weeks, however, if you can’t pay it off in that time, the payday loan company is more than willing to roll it over, and you start all over again. This type of lending is not considered predatory by legal standards so it doesn’t fall under the same regulations as other loans. There is no oversight. Underwriting is not required, so the lender has no obligation to ensure that you can actually pay off the loan in the ten weeks allowed. In Utah, there are a total of 52 Payday lending companies and of those, 32 companies engage in online lending. These companies are able to circumvent the laws of other states that have made Payday lending illegal. In 2006 the Federal Government did cap the interest for military personnel at 36 percent, this was called the Military Lending Act. It does seem that if these interest percentages are too much for active Military, then why wouldn’t they be too much for a single mother, or an older couple living on a fixed income? Over half of Payday loans are given to single women. Payday lending consistently goes up when times are tough, like during a pandemic.

Unarguably it is harder to get a drink of alcohol in Utah than it is to get a loan!

It seems our state has legalized loan sharking!

There are more Payday lenders than McDonald’s, Burger King, 7-11, and Subways. Utah became the first state to ever have a Deferred Deposit Loan business. The first loan company of this type was introduced back in 1985. It popped up right after the Supreme Court relaxed its restrictions on the interest rate in 1978. There are only six states in the country that have not capped interest rates. Owners claim they are helping the less fortunate by allowing access to credit they normally would not have.

Obama’s administration saw the need to regulate predatory lending practices. They were able to pass laws that would give oversight to this style of lending. Loans would have been subject to underwriting to ensure that the borrower could actually pay for the loan. The final rules were to be in effect this past spring, however, after the Payday lenders vacationed at one of Trump’s resorts, the rules were rescinded by Kathleen Kraninger. Kathleen had been in her post at the Consumer Financial Protection agency for only two months where she gave arguments that the CFP was concerned that it was not in citizens’ best interests, and she felt that Payday lending empowers consumers. Let me just mention that the Payday lender convention ended up being pretty expensive, around a million dollars, giving that kind of money directly to a candidate is illegal, but it’s not illegal to give that money to a business.

With a pandemic raging, a minimum wage stagnating at 7.25 an hour, and medical costs raging out of control, it’s no wonder that the Payday lending companies make upwards of 4 billion dollars a year. What our government should take into consideration however, is that by getting rid of predatory lending practices we would increase and strengthen our economy. If our consumers in Utah have more money to spend then everyone benefits. Our own, Chris Peterson, candidate for Utah Governor, testified before Congress in regards to Payday lending practices. Mr. Peterson gave a figure that the average interest percentage is around 400 percent, and yet the organized crime bosses of the 60’s only charged 250 percent interest.

Isn’t it time to put an end to predatory lending that hurts families and our communities? Why are the legislators and even our Attorney General and candidate for Governor accepting contributions from these Payday lenders, when they should be running them out of the state?

Please speak up. Let your vote tell them this is NOT acceptable. Let your state senator and state house representative know that you want legislation to protect consumers and to send these loan sharks out of our state as most other states have done.

You can look up your local representative just plug in your address on this page https://senate.utah.gov/contact

You may also want to look at their donations report and see if you find that they have been accepting money from Title Max and other Pay Day Lenders.

Below this video, you will find reference links for content in the article and also our Top Ten F Grade Legislators that have accepted money from these predatory Pay Lenders instead of passing bills to regulate them! Please look to see if you elected one of these leaders listed in the link for all those Title Max gave money too. If you see them listed, vote them out this election! If not, contact them and ask them to help pass a bill to kick these preditors our of Utah.

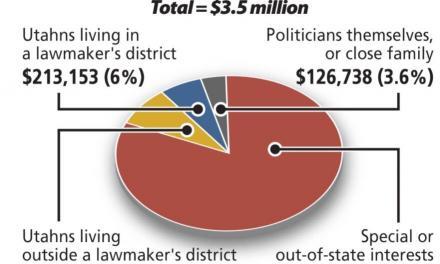

Our elected leaders know what these companies do to our poor to middle-class families, but the 4 million dollars one of these companies alone have contributed in Utah to them has been too tempting to refuse, so they let them continue their loan shark practices in our state when they know they should be working to stop it!

Top Ten F Grade For Utah Legislators & Leaders Accepting Campaign Donations

from “Legalized Loan Sharking” or “Payday Lenders”*

1 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Paul Ray

2 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Calvin Musselman

3 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Timothy Hawkes

4 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Steve Handy

5 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Brad Wilson

6 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Curt Bramble

7 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Spencer Cox

8 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Deidre Henderson

9 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Sean Reyes

10 CFPAU F Grade for accepting donations from Predatory Pay Day Lenders— Stuart Adams

Title Max Gives Utah Legislators 4.2 Million Dollars

*This is just a partial list of Utah’s 29 State Senators and 75 State House Representatives that may have accepted money from these payday lenders that may charge Utahn’s up to 400% interest. It appears that only Republican Candidates received contributions from Title Max that contributed over $4,200,000 dollars to them between 2014-2020 See their report at Title-Max-Donations-2014-2020.xls also at FollowTheMoney.com

Please look up your area representatives to see if they have been supporting these lenders and accepting donations from them. https://senate.utah.gov/contact