Fraud Alert: Insurance Companies

The Utah State Insurance Department defines insurance fraud narrowly and appears to be a one-sided government agency protecting large million to billion-dollar insurance corporations against small-time rip off criminals/individuals that create frauds to obtain coverage or settlements wrongly. They say insurance fraud is:

“Insurance fraud occurs when individuals deceive an insurance company, agent or other person to try to obtain money to which they are not entitled. It happens when someone puts false information on an insurance application and when false or misleading information is given or important information is omitted in an insurance transaction or claim.

Insurance fraud is committed by individuals from all walks of life. The Insurance Fraud Division (IFD) has prosecuted doctors, lawyers, chiropractors, car salesmen, insurance agents, and other persons in positions of trust. Also, anyone who seeks to benefit from insurance through making inflated or false claims of loss or injury.”

But why does the State of Utah NOT also include in their definition of insurance fraud the types of frauds perpetrated by these multi-million dollar insurance companies on our Utah consumers? Don’t harmed Utah consumers matter?

How do we protect Utah consumers that pay years of monthly insurance premiums and then have a car accident and must sue the insurance company to pay them the amount they promised to pay them in their insurance contract?

Even if they win, they are forced to pay the lawyers about a 1/3 of the funds they were promised by the insurance company. This is why you see millions of dollars in TV & Radio advertisements for lawyers like Robert J Debry, Seignfried & Jensen, Craig Swape & Associates “Just One Call, That’s All”, The Advocates and others.

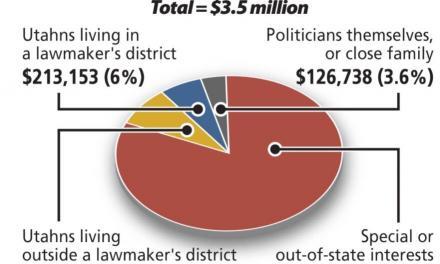

As I began to learn the dark side of our state legislators campaigning with money donated to them from awful preditors on Utah consumers, like payday lenders, surprisingly I noticed many of the lawyers I just mentioned also. Are they donating to the legislators to keep the status quo of consumers needing to hire lawyers to make the insurance companies pay their claims? That’s a nasty business, and it should NOT be acceptable. Instead, we need legislation to protect our consumers from the Insurance companies not paying their claims with criminal penalties so they don’t have to lose a third or more od their settlement to try to collect what is due and owed to them. If they pay their premiums, insurance companies need to pay the claims without these expensive lawyers as middlemen.

Unfortunately, we are learning that there is also fraud on consumers by large insurance companies in NOT paying other types of claims, for example when homes burn down in wildfire claims. Often victims settle for far less than they covered or promised contract amount.

We need to elect legislators committed to protecting consumers. We need to re-organize certain Utah State governmental agencies to better protect our Utah consumers over large multi-million and some billion-dollar companies.

This is our purpose of Consumer Financial Protection Advocates Utah, Inc. to educate and work for change in Utah laws to protect our consumers through state legislators.

Sample Letter Asking for an Insurance Claim Settlement

NOTE: This letter is a sample that must be customized to fit the facts of your individual situation and claim. All bracketed and underlined portions must be completed or revised before sending them. Use this letter to challenge excessive depreciation holdbacks on your personal property claim and/or seek a negotiated claim settlement.

(Date)

(Name of adjuster or highest ranking ins. co. employee)

(Name of insurance co.)

(Address)

Re: Claim Number: ____________

Date of Loss: ____________

Name of Insured:_______________________

Address of Insured Property:_________________________________

Dear _____________,

The purpose of this letter is to request full reimbursement for my family’s personal property that was destroyed (date of loss). The total value of the items that were deemed a total loss is $ ———–. As you know, we have answered every request for information from (insurance company). We have made the property available for inspection multiple times and cooperated fully in providing documentation of our losses.

We understand that (name of insurance company)’s policy is to hold back full payment until after we replace each item and submit receipts. We have every intention of replacing all the items in our home to restore it as it was prior to (date of loss). Our personal belongings were in (very good to excellent) condition at the time of the loss, and we have pictures to prove that (insurance company) has applied excessive depreciation in calculating the actual cash value of our property.

We are anxious to put this painful experience behind us, get back into our home and restore our household. Having to continually submit receipts to your company and wait for full reimbursement for every purchase we make over the next year seems unfairly time-consuming and emotionally painful.

We are asking (insurance company) to make a fair settlement offer on our personal property claim in the amount of the reasonable replacement value of our complete inventory list, less what we’ve already received. Please give this request full consideration and respond no later than (proposed date).

I look forward to (insurance company)’s timely response. Thank you for your anticipated cooperation in this matter.

Sincerely,

YOUR NAME

YOUR MAILING ADDRESS