Consumer Warning & Alert CFP Board of Standards

Consumer Warning & Alert:

CFP Board of Standards, Inc. Owner of the CFP® &

CERTIFIED FINANCIAL PLANNER™ Trademarks

READ Full Report (49 Pages) & Footnote Clip File (304) Pages are available at:

Consumer Warning and Alert CFP Trademark and

CFP Board of Standards Inc.

and

Clip File Warning and Alert CFP Board of Standards Inc. Footnotes

Executive Summary

6/14/2023 9:22:03 AM — Our opinion and review highlights the inappropriateness of trademark credential programs at universities and colleges and utilizing student college savings plans, such as the 529 Plan, from privately owned companies (with trademark credential use by conditional permission companies). Specifically, the CFP® & CERTIFIED FINANCIAL PLANNER™ trademarks owned by the “CFP Board of Standards, Inc..”

To explain the differentiation between various professional credentials, it is essential to note that educational qualifications such as an MBA or other graduate master’s or doctorate degrees from accredited educational institutions or state-regulated credentials, such as the CPA, RN, JD, or MD, which necessitate state licensing. These recognized credentials are rarely revocable unless in the event of a criminal conviction in a Federal or State court of law.

Contrastingly, the CERTIFIED FINANCIAL PLANNER™ and CFP® trademarks, owned by a private company, do NOT carry equivalent protection, nor is it an analogous substitute for an accredited educational degree or state license. It is also crucial to emphasize that the CFP® does not classify as a state-regulated professional credential.[1]

This privately owned trademark should NOT be included as an option for Plan 529 spending on exams or exam prep courses in the H.R.1477, the Freedom To Invest in Tomorrow’s Workforce Act, or be included in the recognized postsecondary credential program list prepared under section 122(d) of the Workforce Innovation and Opportunity Act or other government-funded education plans.[2]

Student college savings invested in qualifying to apply to obtain the use of the CFP® trademark can easily be lost when the permission to use the trademark is revoked for non-payment of annual high fees or failure to comply with the company’s lengthy list of policies, which change frequently.[3]

Even minor infractions or expressing criticism can lead to disqualification[4], resulting in the loss of a significant amount of a student’s college savings. The average cost to qualify for the conditional use of the CFP® trademark is over seven thousand dollars ($7,000) just for the required CFP® courses today.

If Congress passes H.R.1477, the Freedom to Invest in Tomorrow’s Workforce Act. The CFP® trademark use only by permission should NOT be included in the recognized postsecondary credential program list prepared under section 122(d) of the Workforce Innovation and Opportunity Act.

Our case investigation revealed that this company engages in aggressive disciplinary procedures, tarnishing the reputations of individual planners and refusing to rectify false, damaging internet listings. While certain cases’ “Hearings” may exhibit reasonableness and accuracy, our extensive research indicates that there are others, such as the case in this consumer warning and alert, which yield false and unduly detrimental outcomes continuing to damage the student or professional for decades.[5]

Students with conditional permission to use the CFP® trademark face numerous possibilities for its revocation, despite the company owner lacking any state or national regulatory authority. This company irresponsibly publishes false reports and press releases to enhance an image to appear as a regulatory body for the profession while they are NOT one, all while intentionally harming many innocent students and professionals.

Many students regret pursuing the use of the CFP® trademark after investing a substantial level of their educational savings when they find out it is NOT what it was represented to be (96% of jobs in the field are compensated through required insurance and securities licenses and sales commissions.)[6] Or they lose the permission to use the trademark when an issue arises from company policies. Often CFP®s incur difficulties because they are often denied company policy documentation and meaningful responses to their questions or inquiries.[7] [8]

This consumer warning represents a long investigation to resolve our consumer complaint with this company and our extensive background research when the CFP Board of Standards, Inc. company representatives refused to answer any of our questions and provide the complainant consumer or us with any of our requested documentation.[9]

Despite our diligent efforts to foster a cordial, respectful, and amicable relationship aimed at jointly resolving this consumer complaint with the company, regrettably, they have chosen to reject cooperation.

Their response, characterized by an arrogant demeanor, is marred by the inclusion of false and contradictory information, originating from the same attorney who authored all their previous case correspondence to our consumer complainant over many years and after we first requested that he as the one Party named in our Consumer Complaint, NOT represent the CFP Board response, he did so.[10]

Following an extensive and thorough investigation conducted to ensure an equitable assessment of this consumer and company, we have arrived at the conclusion that they have demonstrated a profound lack of diligence in fulfilling the requested responses to both the consumer and our team.

Despite numerous requests over an extended period, even repeating requests for answers and documentation several times, this company has failed to be transparent as they claim on their website and assist their certificant consumer service obligations satisfactorily.

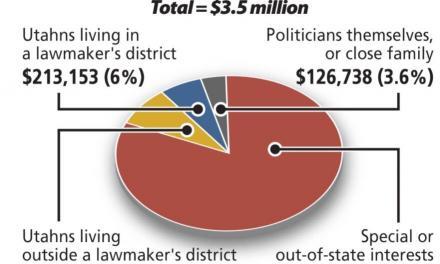

The CFP Board of Standards, Inc. boasts an impressive annual income exceeding forty million dollars ($40,000,000), derived from the licensing fees paid by their Certified Financial Planners (CFP®s also called “certificants”) for the use of their trademarks. Furthermore, their substantial advertising budgets have resulted in expenditures surpassing one hundred and fifty million dollars ($150,000,000) in recent years alone.[11]

Despite this financial prowess, the CEO exhibits unwavering confidence in their ability to dismiss any consumer concerns delegating them to his General Counsel “fixer” for harsh, sometimes threatening, brief partial legal responses.

He displays a disregard for providing suitable or complete responses to both consumers and consumer advocate agencies such as ours.

There is no appropriate consumer response department, team, or company representative that serves to resolve issues to help these CFP® certificant consumers. Often consumer requests don’t get a response, and often if they do, it is a purposely anonymous reply. So that if a question is not answered or is partially answered, the consumer gets the “run around” without the ability to follow up with the same person. It is an intentional tactic to prevent accountability or responsibility for who issued the responses.

CFP® certificant consumers have zero representation or power within or outside the company, so if there is a problem, their only option is to walk away from the trademark use and trademark-owning company and lose all their educational savings and time spent to qualify for permission to use the trademark credential.

Don’t be fooled, this company-owned trademark is NOT like an accredited college awarding an educational degree or even a state-licensed credential like a CPA.

It is simply temporary permission to use a company-owned trademark as a credential with high upfront and annual costs. While the CFP Board promotes that it is comparable to a CPA, to try to make it appear to be a stable profession, a high-in-demand career, with salary positions, it is NOT so. It CANNOT be compared on any level to a CPA, which is a respected, job secure, well-paid salary position, and state-licensed and regulated credential.

We will show in this comprehensive report the industry-wide complaints and significant problems within this company that are difficult for consumers to discover due to the multi-million dollar CFP Board of Standards, Inc. brand advertising and online search engine optimization that hides them.

Consequently, based on these report findings, we issue this strong consumer warning and alert about the Certified Financial Planner Board of Standards, Inc. and assign them a failing grade of “F.”

- Mark Schoeff Jr.. (2019 July 29). CFP Board Omits Thousands of Regulatory, Criminal Problems of its Certificants on consumer site. Investment News.

- Melanie Waddell (2023 April 20) New Bill Allows 529 Plans to Be Tapped for CFP®, CPA Exams. Think Advisor

- Michael Kitcies, (2010 November 12). CFP Board 80% Fee Increase – It’s Official. Michael Kitcies Nerd’s Eye View.

- Jeff Berman, (2022 November 7) Kitces, Other Advisors Stunned by Rude Advisor Sanctioned by CFP Board. AUM Think Advisor.

- Robert Schmansky. (2009 Sep 17). Why CFP Board Failed The Public And Will Again. Forbes.

- Brian Preston, CPA, CFP®, PFS and Bo Hanson, CFA, CFP®. (2020 Jan 17). From Money Guys Podcast, Episode. How and When to Hire a Financial Advisor! YouTube. (See the chart of two CFP® certificants that indicates that CFP®s are about 96% sales agents and only 4% fee-only planners.)

- Patrick Donachie. (2021 July 30). Critics Question the Impact of CFP Board’s Proposed Sanction Revisions: Some Observers Argue the CFP Board’s Proposed Changes Go Too Far and That Its Resources Could Be Better Used Elsewhere―Others Say the Revisions Don’t Go Far Enough. WealthManagement

- Zweig, J., Andrea Fuller (2019, July 30). Looking for a Financial Planner? The Go-To Website Often Omits Red Flags. The CFP Board of Standards, Which Runs LetsMakeAPlan.org, Doesn’t Inform Users About Customer Complaints, Regulatory Skirmishes, and Other Problems. The Wall Street Journal.

- Don Trone. (2018 June 28). CFP Board: Fiduciary Hypocrites. ALM Think Advisor.

- Zweig, J. (2019 August 9). Investors Need This Cop to Toughen Up: Does the Certified Financial Planner Board of Standards Have the Backbone to Improve its Scrutiny of Financial Advice? The Wall Street Journal.

- Robert Schmansky. (2020, March 9). CFP Board Provides Cover for Lying Financial Advisors. Forbes Money Wealth Management. Forbes.

See our related article about: AVOIDING BAD FINANCIAL ADVISORS